7th Pay Commission Standard Pay Scale : Pay matrix with distinct Pay Levels

Seventh CPC is recommending a Pay matrix with distinct Pay Levels instead of Running Pay bands and Grade Pay.

Authority: http://7cpc.india.gov.in/

Highlights of Recommendations of Seventh Central Pay Commission

Recommended Date of implementation: 01.01.2016

Minimum Pay: Based on the Aykroyd formula, the minimum pay in government is recommended to be set at ₹18,000 per month.

Maximum Pay: ₹2,25,000 per month for Apex Scale and ₹2,50,000 per month for Cabinet Secretary and others presently at the same pay level.

Financial Implications:

The total financial impact in the FY 2016-17 is likely to be ₹1,02,100 crore, over the expenditure as per the ‘Business As Usual’ scenario. Of this, the increase in pay would be ₹39,100 crore, increase in allowances would be ₹ 29,300 crore and increase in pension would be ₹33,700 crore.

Out of the total financial impact of ₹1,02,100 crore, ₹73,650 crore will be borne by the General Budget and₹28,450 crore by the Railway Budget.

In percentage terms the overall increase in pay & allowances and pensions over the ‘Business As Usual’ scenario will be 23.55 percent. Within this, the increase in pay will be 16 percent, increase in allowances will be 63 percent, and increase in pension would be 24 percent.

The total impact of the Commission’s recommendations are expected to entail an increase of 0.65 percentage points in the ratio of expenditure on (Pay+Allowances+ Pension) to GDP compared to 0.77 percent in case of VI CPC.

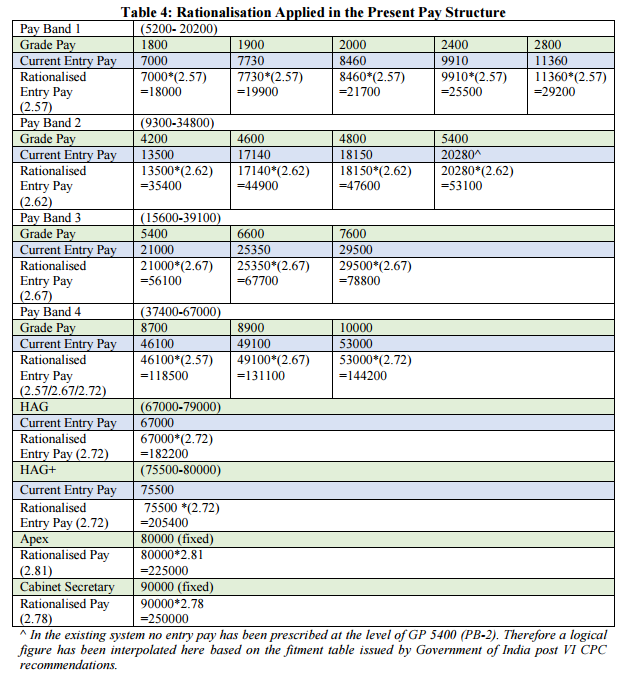

New Pay Structure: Considering the issues raised regarding the Grade Pay structure and with a view to bring in greater transparency, the present system of pay bands and grade pay has been dispensed with and a new pay matrix has been designed. Grade Pay has been subsumed in the pay matrix. The status of the employee, hitherto determined by grade pay, will now be determined by the level in the pay matrix.

Fitment: A fitment factor of 2.57 is being proposed to be applied uniformly for all employees.

Annual Increment: The rate of annual increment is being retained at 3 percent.

Modified Assured Career Progression (MACP):

Performance benchmarks for MACP have been made more stringent from “Good” to “Very Good”.

The Commission has also proposed that annual increments not be granted in the case of those employees who are not able to meet the benchmark either for MACP or for a regular promotion in the first 20 years of their service.

No other changes in MACP recommended.

Cadre Review: Systemic change in the process of Cadre Review for Group A officers recommended.

Allowances: The Commission has recommended abolishing 52 allowances altogether. Another 36 allowances have been abolished as separate identities, but subsumed either in an existing allowance or in newly proposed allowances. Allowances relating to Risk and Hardship will be governed by the proposed Risk and Hardship Matrix.

House Rent Allowance: Since the Basic Pay has been revised upwards, the Commission recommends that HRA be paid at the rate of 24 percent, 16 percent and 8 percent of the new Basic Pay for Class X, Y and Z cities respectively. The Commission also recommends that the rate of HRA will be revised to 27 percent, 18 percent and 9 percent respectively when DA crosses 50 percent, and further revised to 30 percent, 20 percent and 10 percent when DA crosses 100 percent.

In the case of PBORs of Defence, CAPFs and Indian Coast Guard compensation for housing is presently limited to the authorised married establishment hence many users are being deprived. The HRA coverage has now been expanded to cover all.

Any allowance not mentioned in the report shall cease to exist.

Emphasis has been placed on simplifying the process of claiming allowances.

TRANSPORT ALLOWANCE

Pay Level

|

Higher Transport Allowance cities (A, AI)

|

Other places

|

9 and above

|

7200 + DA

|

3600 + DA

|

3 to 8

|

3600 + DA

|

1800 + DA

|

1 and 2

|

1350 + DA

|

900 + DA

|

Advances:

All non-interest bearing Advances have been abolished.

Regarding interest-bearing Advances, only Personal Computer Advance and House Building Advance (HBA) have been retained. HBA ceiling has been increased to ₹25 lakhs from the present ₹7.5 lakhs.

Central Government Employees Group Insurance Scheme (CGEGIS): The Rates of contribution as also the insurance coverage under the CGEGIS have remained unchanged for long. They have now been enhanced suitably. The following rates of CGEGIS are recommended:

Present

|

Proposed

| |||

Level of Employee

|

Monthly Deduction

(₹)

|

Insurance Amount

(₹)

|

Monthly Deduction

(₹)

|

Insurance Amount

(₹)

|

10 and above

|

120

|

1,20,000

|

5000

|

50,00,000

|

6 to 9

|

60

|

60,000

|

2500

|

25,00,000

|

1 to 5

|

30

|

30,000

|

1500

|

15,00,000

|

CASUAL LEAVE – No Change

CHILD Care Leave

1st 365 days – Full pay (100%)

Next 365 days – 80% Pay only.

MATERNITY LEAVE – NO CHANGE -

LEAVE ENCASHMENT AT THE TIME OF RETIREMENT – No change MAXIMUM 300 DAYS ONLY

Medical Facilities:

Introduction of a Health Insurance Scheme for Central Government employees and pensioners has been recommended.

Meanwhile, for the benefit of pensioners residing outside the CGHS areas, CGHS should empanel those hospitals which are already empanelled under CS (MA)/ECHS for catering to the medical requirement of these pensioners on a cashless basis.

All postal pensioners should be covered under CGHS. All postal dispensaries should be merged with CGHS.

Pension: The Commission recommends a revised pension formulation for civil employees including CAPF personnel as well as for Defence personnel, who have retired before 01.01.2016. This formulation will bring about parity between past pensioners and current retirees for the same length of service in the pay scale at the time of retirement.

The past pensioners shall first be fixed in the Pay Matrix being recommended by the Commission on the basis of Pay Band and Grade Pay at which they retired, at the minimum of the corresponding level in the pay matrix.

This amount shall be raised to arrive at the notional pay of retirees, by adding number of increments he/she had earned in that level while in service at the rate of 3 percent.

In the case of defence forces personnel this amount will include Military Service Pay as admissible.

Fifty percent of the total amount so arrived at shall be the new pension.

An alternative calculation will be carried out, which will be a multiple of 2.57 times of the current basic pension.

The pensioner will get the higher of the two.

Gratuity: Enhancement in the ceiling of gratuity from the existing ₹10 lakh to ₹20 lakh. The ceiling on gratuity may be raised by 25 percent whenever DA rises by 50 percent.

New Pension System: The Commission received many grievances relating to NPS. It has recommended a number of steps to improve the functioning of NPS. It has also recommended establishment of a strong grievance redressal mechanism.

Regulatory Bodies: The Commission has recommended a consolidated pay package of ₹4,50,000 and ₹4,00,000 per month for Chairpersons and Members respectively of select Regulatory bodies. In case of retired government servants, their pension will not be deducted from their consolidated pay. The consolidated pay package will be raised by 25 percent as and when Dearness Allowance goes up by 50 percent. For Members of the remaining Regulatory bodies normal replacement pay has been recommended.

Performance Related Pay: The Commission has recommended introduction of the Performance Related Pay (PRP) for all categories of Central Government employees, based on quality Results Framework Documents, reformed Annual Performance Appraisal Reports and some other broad Guidelines. The Commission has also recommended that the PRP should subsume the existing Bonus schemes.

There are few recommendations of the Commission where there was no unanimity of view and these are as follows:

The Edge: An edge is presently accordeded to the Indian Administrative Service (IAS) and the Indian Foreign Service (IFS) at three promotion stages from Senior Time Scale (STS), to the Junior Administrative Grade (JAG) and the NFSG. is recommended by the Chairman, to be extended to the Indian Police Service (IPS) and Indian Forest Service (IFoS).

Shri Vivek Rae, Member is of the view that financial edge is justified only for the IAS and IFS. Dr. Rathin Roy, Member is of the view that the financial edge accorded to the IAS and IFS should be removed.

Superannuation: Chairman and Dr. Rathin Roy, Member, recommend the age of superannuation for all CAPF personnel should be 60 years uniformly. Shri Vivek Rae, Member, has not agreed with this recommendation and has endorsed the stand of the Ministry of Home Affairs.

7th CPC report on Department of Posts

19/11/2015

7th Cpc Rejected all our (FNPO&NFPE) demands directly, what is our next course of action?

Please read page no 466to 477Report of 7th cpc.

The 7th Pay Commission submits its report to the Central Government -

Click the above link to view the report

.22 per cent pay hike for Central staff, could go up to 30: Proposal of pay panel - Indian Express - Updated:November 19, 2015 7:31 am

7th Cpc Rejected all our (FNPO&NFPE) demands directly, what is our next course of action?

Please read page no 466to 477Report of 7th cpc.

Highlights of Recommendations of Seventh Central Pay Commission.

Recommended Date of implementation: 01.01.2016

Minimum Pay: Based on the Aykroyd formula, the minimum pay in government is recommended to be set at ?18,000 per month.

Maximum Pay: ?2,25,000 per month for Apex Scale and ?2,50,000 per month for Cabinet Secretary and others presently at the same pay level.

Financial Implications:

The total financial impact in the FY 2016-17 is likely to be ?1,02,100 crore, over the expenditure as per the ‘Business As Usual’ scenario. Of this, the increase in pay would be ?39,100 crore, increase in allowances would be ? 29,300 crore and increase in pension would be ?33,700 crore.

Out of the total financial impact of ?1,02,100 crore, ?73,650 crore will be borne by the General Budget and ?28,450 crore by the Railway Budget.

In percentage terms the overall increase in pay & allowances and pensions over the ‘Business As Usual’ scenario will be 23.55 percent. Within this, the increase in pay will be 16 percent, increase in allowances will be 63 percent, and increase in pension would be 24 percent.

The total impact of the Commission’s recommendations are expected to entail an increase of 0.65 percentage points in the ratio of expenditure on (Pay+Allowances+ Pension) to GDP compared to 0.77 percent in case of VI CPC.

New Pay Structure: Considering the issues raised regarding the Grade Pay structure and with a view to bring in greater transparency, the present system of pay bands and grade pay has been dispensed with and a new pay matrix has been designed. Grade Pay has been subsumed in the pay matrix. The status of the employee, hitherto determined by grade pay, will now be determined by the level in the pay matrix.

Fitment: A fitment factor of 2.57 is being proposed to be applied uniformly for all employees.

Annual Increment: The rate of annual increment is being retained at 3 percent.

Modified Assured Career Progression (MACP):

Performance benchmarks for MACP have been made more stringent from “Good” to “Very Good”.

The Commission has also proposed that annual increments not be granted in the case of those employees who are not able to meet the benchmark either for MACP or for a regular promotion in the first 20 years of their service.

No other changes in MACP recommended.

House Rent Allowance: Since the Basic Pay has been revised upwards, the Commission recommends that HRA be paid at the rate of 24 percent, 16 percent and 8 percent of the new Basic Pay for Class X, Y and Z cities respectively. The Commission also recommends that the rate of HRA will be revised to 27 percent, 18 percent and 9 percent respectively when DA crosses 50 percent, and further revised to 30 percent, 20 percent and 10 percent when DA crosses 100 percent.

In the case of PBORs of Defence, CAPFs and Indian Coast Guard compensation for housing is presently limited to the authorised married establishment hence many users are being deprived. The HRA coverage has now been expanded to cover all.

Any allowance not mentioned in the report shall cease to exist.

Emphasis has been placed on simplifying the process of claiming allowances.

Transport Allowance

Pay Level

|

Higher TPTA Cities(₹ pm)

|

Other Places(₹ pm)

|

9and above

|

7200+DA

|

3600+DA

|

3 to 8

|

3600+DA

|

1800+DA

|

1 and 2

|

1350+DA

|

900+DA

|

Advances:

All non-interest bearing Advances have been abolished.

Regarding interest-bearing Advances, only Personal Computer Advance and House Building Advance (HBA) have been retained. HBA ceiling has been increased to ?25 lakhs from the present ?7.5 lakhs.

Central Government Employees Group Insurance Scheme (CGEGIS): The Rates of contribution as also the insurance coverage under the CGEGIS have remained unchanged for long. They have now been enhanced suitably.

Medical Facilities:

Introduction of a Health Insurance Scheme for Central Government employees and pensioners has been recommended.

Meanwhile, for the benefit of pensioners residing outside the CGHS areas, CGHS should empanel those hospitals which are already empanelled under CS (MA)/ECHS for catering to the medical requirement of these pensioners on a cashless basis.

All postal pensioners should be covered under CGHS. All postal dispensaries should be merged with CGHS.

Pension: The Commission recommends a revised pension formulation for civil employees including CAPF personnel as well as for Defence personnel, who have retired before 01.01.2016. This formulation will bring about parity between past pensioners and current retirees for the same length of service in the pay scale at the time of retirement.

The past pensioners shall first be fixed in the Pay Matrix being recommended by the Commission on the basis of Pay Band and Grade Pay at which they retired, at the minimum of the corresponding level in the pay matrix.

This amount shall be raised to arrive at the notional pay of retirees, by adding number of increments he/she had earned in that level while in service at the rate of 3 percent.

In the case of defence forces personnel this amount will include Military Service Pay as admissible.

Fifty percent of the total amount so arrived at shall be the new pension.

An alternative calculation will be carried out, which will be a multiple of 2.57 times of the current basic pension.

The pensioner will get the higher of the two.

Gratuity: Enhancement in the ceiling of gratuity from the existing ?10 lakh to ?20 lakh. The ceiling on gratuity may be raised by 25 percent whenever DA rises by 50 percent.

Performance Related Pay: The Commission has recommended introduction of the Performance Related Pay (PRP) for all categories of Central Government employees, based on quality Results Framework Documents, reformed Annual Performance Appraisal Reports and some other broad Guidelines. The Commission has also recommended that the PRP should subsume the existing Bonus schemes.

There are few recommendations of the Commission where there was no unanimity of view and these are as follows:

The Edge: An edge is presently accordeded to the Indian Administrative Service (IAS) and the Indian Foreign Service (IFS) at three promotion stages from Senior Time Scale (STS), to the Junior Administrative Grade (JAG) and the NFSG. is recommended by the Chairman, to be extended to the Indian Police Service (IPS) and Indian Forest Service (IFoS).

Shri Vivek Rae, Member is of the view that financial edge is justified only for the IAS and IFS. Dr. Rathin Roy, Member is of the view that the financial edge accorded to the IAS and IFS should be removed.

Empanelment: The Chairman and Dr. Rathin Roy, Member, recommend that All India Service officers and Central Services Group A officers who have completed 17 years of service should be eligible for empanelment under the Central Staffing Scheme and there should not be “two year edge”, vis-à-vis the IAS. Shri Vivek Rae, Member, has not agreed with this view and has recommended review of the Central Staffing Scheme guidelines.

Non Functional Upgradation for Organised Group ‘A’ Services: The Chairman is of the view that NFU availed by all the organised Group `A’ Services should be allowed to continue and be extended to all officers in the CAPFs, Indian Coast Guard and the Defence forces. NFU should henceforth be based on the respective residency periods in the preceding substantive grade. Shri Vivek Rae, Member and Dr. Rathin Roy, Member, have favoured abolition of NFU at SAG and HAG level.

Superannuation: Chairman and Dr. Rathin Roy, Member, recommend the age of superannuation for all CAPF personnel should be 60 years uniformly. Shri Vivek Rae, Member, has not agreed with this recommendation and has endorsed the stand of the Ministry of Home Affairs.

The 7th Pay Commission submits its report to the Central Government -

Click the above link to view the report

.22 per cent pay hike for Central staff, could go up to 30: Proposal of pay panel - Indian Express - Updated:November 19, 2015 7:31 am

Dissent in 7th pay panel over edge for IAS & IFS

The Seventh Pay Commission, chaired by Justice A.K. Mathur, will submit to Union Finance Minister Arun Jaitley on Thursday recommendations for an average 15-16 per cent increase in pay, allowances and pensions for Central government employees, lower than the 20 per cent suggested by the Sixth Pay Commission on the basis of which the then government revised the pay scales by nearly 40 per cent with effect from 2006.

“The less generous recommendation reflects that the economy isn’t booming now as it was then,” a member of the Commission told The Hindu. The Modi government is expected to revise pays, pensions and allowances, on the basis of the Seventh Pay Commission’s recommendations, with effect from January 1, 2016, for 48 lakh employees and 54 lakh pensioners.

Top sources told The Hindu that the report could not reach an agreement on “controversial” issues such as if and how the edge the IAS and the IFS officers enjoyed over other services should be maintained, and the report included multiple dissent notes from its members.

The chairman has recommended that the current practice — in which the pays of all officers recruited in a particular year are upgraded within two years of the first officer of the batch getting promotion — be extended to all services, including defence and central paramilitary services. The dissenting member, however, has suggested that the government get rid of this rule so that pay upgrade for officers, including IAS and IFS, should come off only after they themselves get promoted rather than within two years of the promotion of the first officer of their batch. Another dissenting member has recommended status quo.

On the empanelment of officers above the level of joint secretary for deputation to the Centre, the chairman and a member have recommended that officers of non-IAS and non-IFS services of a batch be considered. But the dissenting member suggested maintaining status quo.

The commission will also submit a recommendation on an alternative approach to the one rank one pension for defence personnel.

The cost of the recommendations, if accepted by the Centre, works out to 0.6% of the GDP in the first year of implementation, lower than that of the Sixth Pay Commission, which was 0.77%. In nominal terms, the rise is more than Rs. 1 lakh crore against the nearly Rs.18,000 crore following the Sixth Pay Commission’s award, which also resulted in additional arrears of Rs.30,000 crore. The per month ‘cost to company’ for the Centre will rise to Rs.4 lakh crore.

However, as percentage of the revenue expenditure, the cost is put at 18.5 per cent of the estimate in the budget for the current year. It was 22.3 per cent for the first year of the implementation of the Sixth Pay Commission.

In the report to be submitted on Thursday, the commission has also recommended substantial rises in the HRA to officers in lieu of government accommodation.

No comments:

Post a Comment